Does Home Insurance Cover Bathroom Leaks?

Bathroom leaks can range from minor annoyances to significant sources of water damage, potentially impacting not only the bathroom itself but also surrounding areas. Understanding whether homeowner's insurance covers these leaks is crucial for mitigating financial losses. However, coverage varies depending on the cause of the leak and the specific policy details.

Sudden and accidental discharges are generally covered by standard homeowner's insurance policies. This includes events such as a pipe bursting due to freezing temperatures or a supply line suddenly rupturing. The resulting water damage to the structure of the home and personal belongings within is typically included within the scope of coverage.

Gradual leaks, however, present a different scenario. Slow leaks that develop over time, such as a dripping faucet or a slowly leaking pipe behind a wall, are often excluded from standard coverage. This is because these leaks are considered maintenance issues, falling under the homeowner's responsibility to prevent. The rationale behind this exclusion is that regular maintenance and timely repairs can prevent such leaks from escalating into significant damage.

Differentiating between sudden and gradual leaks can be challenging. A seemingly sudden leak might be the result of a long-term, undetected gradual leak that finally manifested as a burst pipe. Insurance companies often investigate the source and duration of a leak to determine coverage eligibility. Evidence such as corrosion, mineral buildup, or slow water stains may indicate a long-term leak, potentially leading to a denied claim.

The location of the leak also plays a role in coverage. Leaks originating within the home's plumbing system are typically covered under standard policies for sudden occurrences. However, leaks originating from external sources, such as groundwater seepage or a leaking roof, might fall under different coverage categories or be excluded entirely. Reviewing the policy details and understanding the covered perils is essential.

Mold growth resulting from water damage is another critical factor to consider. While homeowner's insurance might cover the initial water damage from a covered leak, coverage for mold remediation can vary significantly. Some policies offer limited mold coverage, while others exclude it altogether. It's crucial to check policy specifics regarding mold coverage limits and requirements for remediation.

Deductibles apply to covered water damage claims, just like any other claim. The homeowner is responsible for paying the deductible amount before the insurance coverage begins. Choosing the right deductible amount involves balancing upfront costs with potential out-of-pocket expenses in the event of a claim. A higher deductible typically results in lower premiums, but it also means a higher out-of-pocket expense when filing a claim.

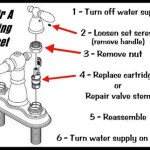

Preventing bathroom leaks is the best approach to avoid the hassle and expense of filing a claim. Regular maintenance, such as checking for leaks, inspecting pipes, and promptly addressing minor issues, can prevent significant damage. Properly caulking around fixtures, ensuring adequate ventilation, and monitoring water pressure can also help prevent leaks from occurring.

When a leak does occur, prompt action is crucial. Shutting off the water supply to the affected area can minimize damage. Documenting the damage with photographs and videos can be helpful when filing a claim. Contacting the insurance company as soon as possible to report the leak and initiate the claims process is essential.

Each homeowner's insurance policy is unique, and coverage specifics can vary greatly. Thoroughly reviewing the policy documentation to understand covered perils, exclusions, and limitations is essential. Contacting the insurance provider directly for clarification on coverage regarding specific scenarios, such as bathroom leaks, is always recommended. Understanding the nuances of coverage can help homeowners make informed decisions about repairs, maintenance, and potential claims.

Furthermore, homeowners should regularly review their policies, especially when renewing or making changes to their coverage. Life changes, home renovations, and even changes in the local climate can impact insurance needs. Keeping the policy up-to-date and aligned with current circumstances ensures adequate protection in the event of unforeseen events like bathroom leaks.

Seeking professional advice from a licensed insurance agent can also be beneficial. An agent can help homeowners navigate the complexities of insurance policies, understand coverage options, and select the most appropriate coverage for their individual needs and risk tolerance. Having a trusted insurance professional as a resource can provide valuable guidance throughout the insurance process.

Does Homeowners Insurance Cover Plumbing And Leaks Claimsmate

Does Home Insurance Cover Plumbing Fearnow

Does Home Insurance Cover Water Damage Farmers

Does Homeowners Insurance Cover Plumbing And Pipe Leaks Valuepenguin

Does Home Insurance Cover Plumbing Leaks Quotewizard

How To Help Detect And Prevent Bathroom Leaks Travelers Insurance

Does Homeowners Insurance Cover Water Damage Quicken Loans

Does Homeowners Insurance Cover Water Damage Progressive

Does Home Insurance Cover Water Damage

Is Mold Covered By Homeowners Insurance

See Also